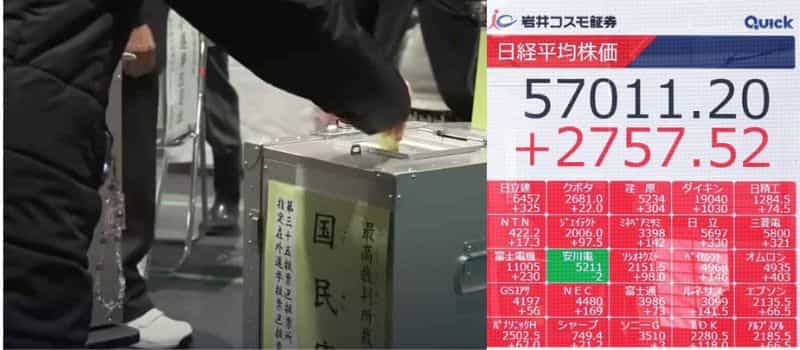

U.S. stock markets were mostly lower on January 13, 2026 as Investors reacted to the first earnings reports and the latest inflation numbers. Major stock market including the Dow Jones Industrial Average, S&P 500, and Nasdaq composite finished the day slightly down after earlier record levels.

On Tuesday, the S&P 500, a important number of U.S. stocks, fell by about 0.2%. The Dow Jones Industrial Average dropped nearly 0.8%, while the Nasdaq Composite went down around 0.1%. These declines followed a positive start in recent weeks, but Wednesday’s results showed how quickly markets can change.

Some of the market’s change happened after one of the first big earnings reports of the season. JPMorgan Chase, the largest U.S. bank, reported results that were not as strong as some investors expected. When a big company reports weak profits or revenue, it can make investors insecure and lead to a drop in stock prices.

Another factor was a new inflation reading. A report that measures how much prices for everyday goods and services have changed. The data showed that prices went up more slowly than some experts expected, meaning inflation might be slowdown. This kind of information affects expectations about what the Federal Reserve might do with interest rates later in the year.

When inflation stays slows, investors sometimes expect the central bank to cut interest rates. Lower rates can help make borrowing cheaper and help the economy grow. In this case, the price report suggested the U.S. central bank to cut rates at least twice in 2026, which helped some parts of the market.

Banking stocks were among the most affected on Tuesday. In addition to JPMorgan, other major banks like Bank of America, Citigroup, and Wells Fargo saw shares decline as profit reports and worries about the future made people less confident.

Even though the declines on Tuesday, overall market performance for the week showed mixed results. Some stocks, like the broader Russell 2000 of smaller companies, saw slight gains, while others remained same for the week. so far this year, the stock market including S&P 500 and Nasdaq still showed modest growth.

Some analysts point out that markets have recently reached record highs, and pullbacks can happen after strong runs. For example, earlier in the month, the S&P 500 and Dow both hit new closing records before turning lower. These changes show how investor expectations and economic news can influence daily moves.

Tech and growth stocks also played a role. Companies in the technology sector have been main reason of market gains in recent months, but shifts in investor focus including reactions to earnings and inflation can make these stocks more volatile.

The U.S. stock market did not keep its early gains on Tuesday. Weak results from a major bank and new price data forced investors to sell shares, which caused the major stocks to fall. Still, some parts of the market remained steady, and overall market trends are mixed as investors wait for more earnings reports and economic data in the coming days.